Is my IRA insured?

Retirement Account protection is separate and apart from insurance coverage on other credit union accounts, providing you with additional protection. IRA accounts are insured separately from the share account up to $250,000.

*and members of your immediate family. (Immediate family members are: spouse, child, step-child, sibling, parent, grandparent or grandchild.)

Retirement Account protection is separate and apart from insurance coverage on other credit union accounts, providing you with additional protection. IRA accounts are insured separately from the share account up to $250,000.

YES, each Fairfield Federal Credit Union share account is insured up to at least $250,000 by the National Credit Union Share Insurance Fund by NCUA. A "share account" includes all the non-IRA deposit accounts for a primary account holder: savings, checking, and certificates.

There are NO per-check or monthly fees on a personal checking account, nor is there a minimum balance requirement.

A $5.00 minimum balance is required to maintain membership in the Credit Union.

A $300.00 minimum balance is required to earn dividends on a share (savings) account.

There is no joining fee, but you are required to open a share (savings) account with a minimum $5 deposit. This represents your share of membership.

To join, you must present valid indentification and proof of eligibility, then open a share (savings) account with a minimum $5.00 deposit. Acceptable forms of identification are:

· Valid Driver's License with photo

· Social Security card

· Birth Certificate

· Employer ID with photo (or copy of check stub)

· Government-issued document that provides evidence of nationality and bears a photo or similar safeguard.

· Passport

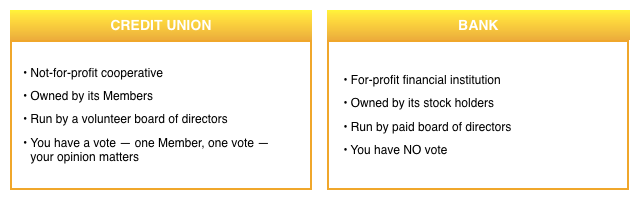

A credit union is a not-for-profit, cooperative financial institution owned and controlled by its Members.

If You* Reside, Work, Worship, Own a Business or Other Operation, or

Attend a School Located in Jefferson County, You Are Eligible to Join!